How to Detect Problems in Your Marketing Communications Channels: What is Customer Acquisition Cost

You may launch great marketing campaigns, but your budget on this may exceed the revenue you get from the customers. Some of your communication can bring 90% of revenue, while others will only create additional expenses. Stop losing money. In this case, you must pause and decide which is more effective. Customer acquisition cost (or CAC) is the metric that can help you to find this out.

Let’s take the example of Madison. She’s the head of marketing in a middle-sized company, and the traffic on their website is about 100 000 users every month. Her team constantly launches campaigns to acquire more and more users. They spend $1000 on all their marketing activities which is quite a lot for their company, but the number of users remains.

How does the Customer Acquisition Cost metric help Madison understand what’s happening? Let’s explore.

Maybe, you would rather watch this article? Check out the video below!

What is Customer Acquisition Cost?

I’ll briefly write the definition just if you hear about this metric for the first time.

Customer Acquisition Cost (or CAC) is the price you pay to acquire a new product user.

Sometimes people mix up Customer Acquisition Cost and Cost per Action. These notions are close to each other but are still about different things. CPA is about the cost of every target action in your marketing campaign, while CAC allows you to estimate all the price you had before a person became your customer.

How to calculate

There are two ways to calculate Customer Acquisition Cost for your product: basic and pro. Let’s find out.

Basic method

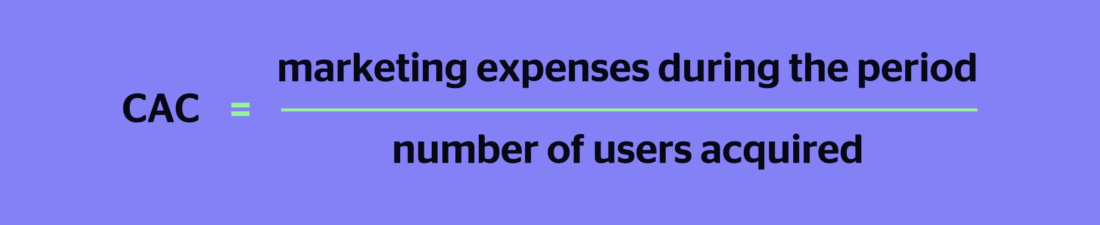

This method works only in case you need to evaluate the average price of acquisition; you may use this formula:

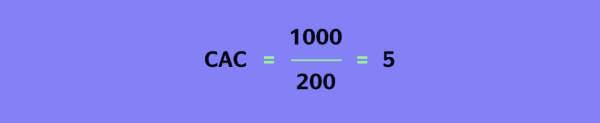

As I said, Madison’s marketing budget was $1000. So, in case they attract, say, 200 new users, the acquisition of every new customer costs $5:

Once again: this way of calculation can’t show the actual cost of your customers but will help you evaluate the average acquisition price.

Pro method

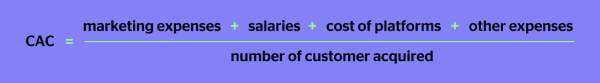

If you need to know the exact numbers, this method is for you. To tell the truth, you spend more money on acquiring customers — this is not just a marketing budget. You pay salaries, pay for some platforms that your specialists use during their work, and other expenses.

Also, don’t forget that we need to calculate Customer Acquisition Cost for every acquisition channel. Otherwise, you won’t decide which channel is more effective and which you should eliminate.

So, to get the complete picture of your marketing campaign effectiveness, you may use this formula:

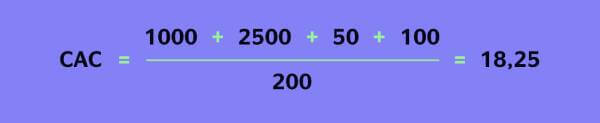

In terms of Madison, this month they’ve acquired 200 customers and a marketing budget of $1000. Additionally, to these expenses that we’ve already taken into account, we’ll need to add the marketer’s salary who works with this acquisition channel (let it be $2 500 salary of the email marketer) and the fee for the services they use (about $50). And other expenses would be $100. Therefore, acquisition of one customer would cost for you:

You can see how the cost for every user you acquired dramatically grew from $5 to $18,25. Therefore, if you want to estimate your Customer Acquisition Cost more objectively, use this formula.

What CAC is good?

Well. Madison calculated their CAC for every acquisition channel. They have some numbers and don’t know what to do with them.

What’s next? The obvious question comes to mind after calculating Customer Acquisition Cost — is there a benchmark, and what’s this?

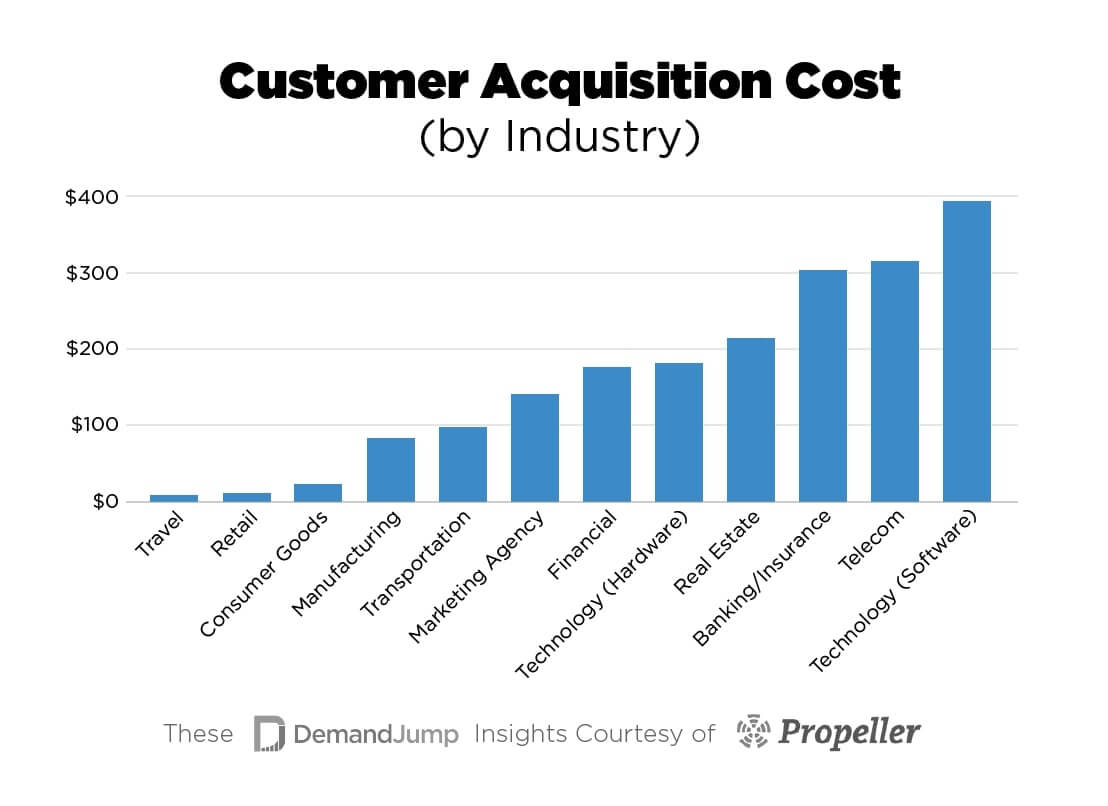

According to DemandJump, there are. See what numbers are considered good ones in different industries. Note that these are aggregated numbers for all the acquisition channels:

But to tell the truth, they don’t make any sense until you know how much these customers bring to your company.

For example, Madison’s Customer Acquisition Cost maybe $400, while the Average Lifetime Value that customers bring equally $1000. In this case, she’s making a $600 profit which sounds good. But let’s consider an opposite situation — say their Customer Acquisition Cost is the same as $400, while every user brings only $250. Therefore, Madison’s loss is $150 for every user, which is less desirable than in the first situation I’ve just described.

So, there is a big chance that even if your CAC matches the benchmark, you’ll still have significant losses. To avoid this, you need to calculate and monitor the Lifetime value of your users and compare this with Customer Acquisition costs.

So, let’s discuss LTV in more detail.

What is Lifetime Value

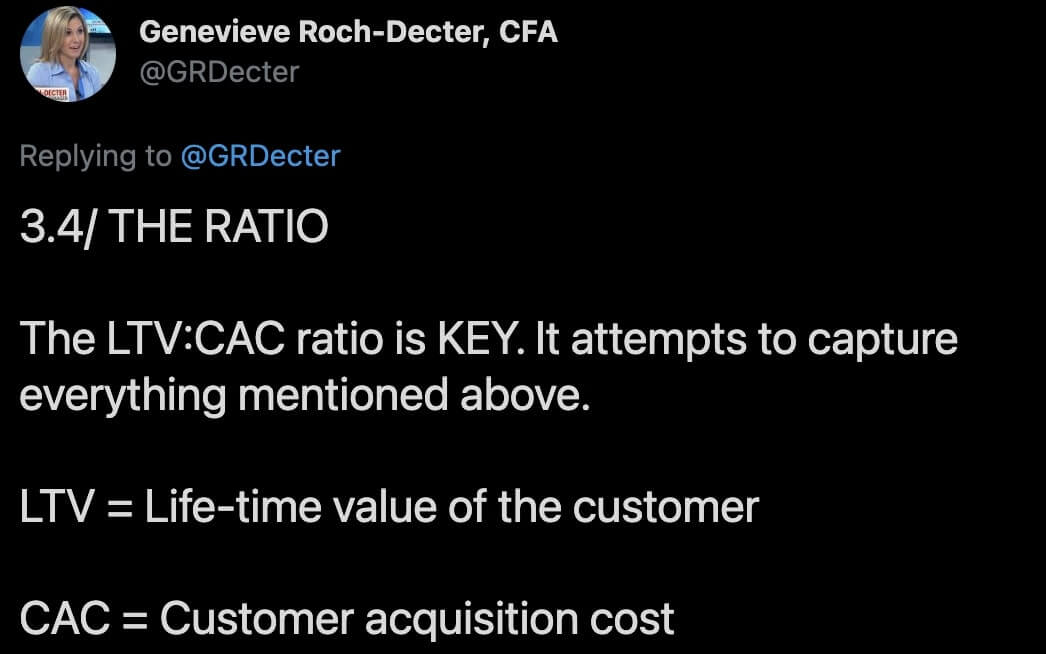

Searching information about Customer Acquisition Cost, Madison discovered that many experts consider CAC together with Lifetime Value. More than that, some of them even calculate the LTV: CAC ratio:

So, Madison needs to understand what’s LTV and how to calculate this.

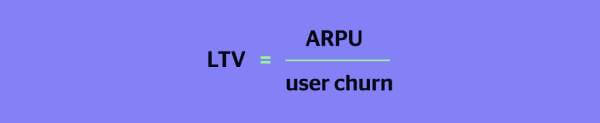

LTV, or Lifetime Value, is a calculation of profit that the user brought to you during your relationships. This calculation formula is straightforward:

And the other way to calculate:

The more your LTV, the better it is. But let’s get back to our ratio.

LTV: CAC compares the value that the customer made to the costs you’ve spent to attract them.

If this ratio is less than one, your business is in bad condition, and you need to start doing something not to become bankrupt.

If this ratio is more than one, your business is willing to create value, but you still have many things to improve.

Finally, if the ratio is more than three, this may be considered ‘good.’ But as we know, the sky’s the only limit.

However, you should be careful when estimating this ratio. Many factors affect both LTV and CAC. For example, your churn rate may drop or grow from month to month, which will affect the ratio. This will affect the ratio and show positive or negative dynamics.

To make a more independent withdrawal about your CAC, you need to analyze the LTV: CAC ratio of dynamics and analyze what exactly affected the change.

We already have an article about this metric; read this if you need some more info about LTV.

Download 40 templates of growth marketing campaigns to increase your website conversion

- triggered pop-ups,

- chatbots,

- email campaigns

- and revenue forecast

Thanks! Now check your inbox

How to affect CAC

When Madison calculated both CAC and LTV, she understood that there is quite a big problem with their CAC — compared with the last period, this increased by 10%, and the marketing budget didn’t pay off. How can marketers help themselves? We asked experts for help:

There are direct and indirect ways to I prove CAC. Direct — optimized targeting, improved tracking (investing into clicks data), partnerships. Indirect — many marketing campaigns focused on improving CAC based on content management (blogs, social media) to ads.

To clarify both for you and Madison, we’ll describe these and other ways to improve SaaS in more detail.

1. Retargeting

There is always a dilemma: acquire an entirely new audience or retarget those who already interacted with your product and try to prove your value again.

We claim that retargeting is much cheaper and better for customer engagement strategy. Why?

- The engagement rate in retargeting campaigns is 152% higher on average;

- Retargeting users make 37% more revenue.

When you show your ads to an audience that already interacted with you, the chance of a higher conversion rate, these people already saw your ads. More than that: they probably even explored your product but, for some reason, left. Retargeting can help you to remind yourself and nurture these leads to a purchase.

Read also: 15 customer engagement platforms to boost your website conversion.

2. Test before a big launch

Sounds obvious, but still, not all companies adhere to this principle. Madison’s isn’t an exception.

Only one out of 10 hypotheses succeed. So, how can you be sure the campaign you’ve launched without testing will gain money instead of spoiling your marketing budget?

Recently, we tested the positioning of a new feature. We launched 12 offers options, and now we use this one that had a higher CTR as a positioning.

Launch several ad campaigns on Facebook or use Dashly A/B tests if you need to test your offers directly on your website.

Read also:

- Attract customers with these 24 ecommerce lead magnets

- The 7 Key Email Marketing Metrics & KPIs You Should Be Tracking

3. Focus on your Ideal Customer Profiles and Buyer Personas

Usually, you can’t have the same value proposition for two segments.

Say, Madissson’s selling a collaborative board. Their audience is quite broad, but let’s take two of the biggest ones: students who use this board to make notes and employees who use this to collaborate with their co-workers. The value for the student would be the ability to save all their messages in one place, make notes in an ideal way, and quickly find this when needed. The value for employees is sharing this workspace with their colleagues and collaborating on their projects.

As the value of your product differs from segment to segment, you need to create several offers and use this on relevant audiences. Otherwise, you risk spoiling your budget and not acquiring anyone at all.

Never forget who you’re doing your product for — analyze Buyer Personas and ICPs to be closer to your target audience and create exciting offers.

We have an article about our experience of creating buyer personas. Also, there is a guide on ICP. So, you have all the resources to create an ad that corresponds with your audience’s value.

Read also:

Product adoption: 7 tips to prove your value

4. Collect as much data as possible

This point is hugely related to the previous one. Remember to have several buyer personas (i.e., cohorts) when analyzing their data. Divide the data into cohorts, search for patterns, and act according to insights in every cohort. Soon, with user tracking on website you’ll get relevant data about every user cohort and will be able to affect their behavior by marketing communications if this is needed.

Track website visitors’ behavior and their interactions with your company, and always have it at your hands in the Lead Card

5. Automate everything you can automate

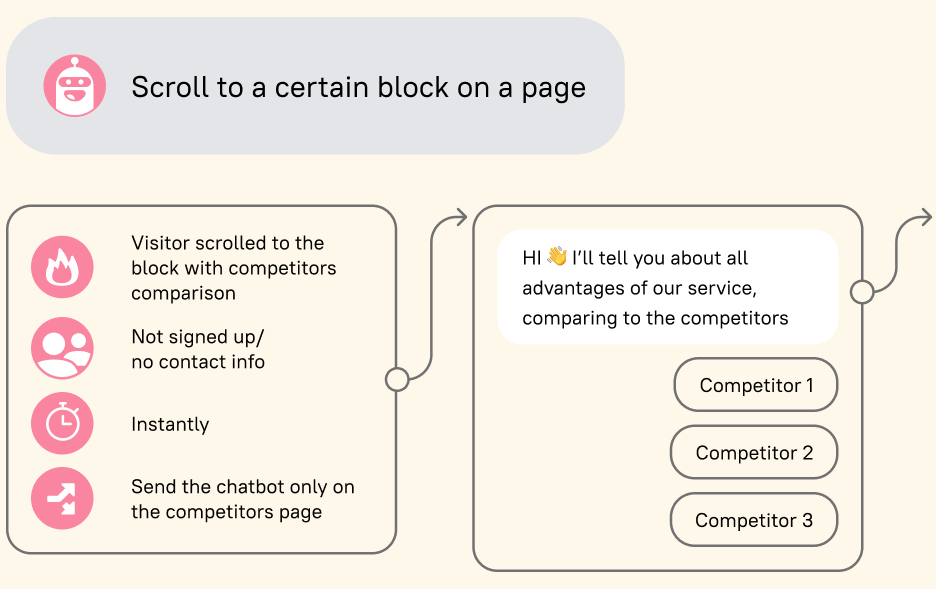

Besides saving money on salaries, you will collect rather more data than if you did it manually. For example, you may use ready-made campaigns that were developed to move a user to the bottom of the funnel automatically. What do I mean by this?

Let’s get back to Madison’s case. Say they launched a Facebook ads campaign, and the traffic from this campaign goes to their website. The value proposition in ads corresponds with what they offer on the website — users get what they want.

Of course, some users find Madison’s helpful product, signing up and buying without any additional questions.

But this is a tiny part of all the traffic. What happens to the majority?

- Somebody had questions about the product but didn’t find any place where to ask them and finally left,

- Somebody wasn’t nurtured enough and also left,

- Somebody left for another reason. At least, we can’t know all the reasons.

It seems that those several people who made a purchase cost too much for Madison. But she still can affect this situation. How? Using marketing automation.

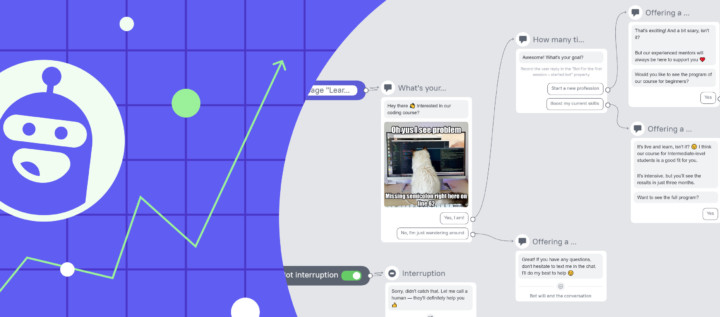

- Suppose product owners see a 40% rise in average time spent on the landing page after they start using the chatbot. The lead generation chatbot could have answered simple questions from Madison’s FAQ or assigned the conversation to a competent agent. These users won’t leave and probably would buy.

- Sometimes you need to capture emails from website visitors, send them valuable materials, and wait until they buy from you. Madison didn’t collect contacts. And, of course, she didn’t launch a nurturing campaign. As a result — many users who could buy from her just left. The money that Madison spent on their acquisition was just spoiled. Instead, they might have collected leads using pop-ups or a chatbot platform and then nurtured them with email marketing. The best customer engagement strategies are focused on the existing client because it is much cheaper than to acquiring new ones.

Feel this? Marketing automation can increase your sales by 14%. Thus, the Customer Acquisition Cost will also become lower number.

Read also:

👉 Lead nurturing platform for your revenue growth

👉 12 types of marketing nurture campaigns

6. Increase loyalty and decrease churn rate

When you lose customers, the acquisition cost increases (remember the CAC formula?). Never miss customers’ questions, help them with issues, and be open and friendly. Madison knew this, so there were no problems with loyalty in her company. But anyway, let’s find out how you can affect this.

1. Never forget about customer service importance

How to do this? Always keep in touch with your customers to make their life easier and help them deal with their problems. Obvious but still worth your attention. Users always feel you care about their issues and pay back with loyalty. Ensure you the customer service tool you use fits all the customer requirements. Check these Drift alternative, for example.

2. Don’t be afraid to remind about yourself

On average, it takes eight attempts to reach the customer. Some customers churn not because they don’t love your product — they forget that they’ve signed up for this. Therefore, there is an obvious outcome — don’t be shy to remind yourself about yourself. Especially when retaining customers through follow-ups is 6-7 times cheaper than acquiring a new one.

3. Stay notified about customers in real-time

This way, you’ll know about the problem fast and will be able to react faster and maybe even prevent churn.

We have a great video on how to increase churn rate; take a look at this in case you have some questions left:

FAQ

This is the price you pay to acquire a new product user. Read how to calculate it in the article.

There are two ways to do this. The first one is basic and allows us to understand the overall picture of the CAC. This includes only direct spending on user acquisition: CAC = marketing expenses during a period/number of users acquired.

The second one is used when you need to get the full view of CAC. This includes all the indirect spending like marketing expenses + salaries + cost of platforms + other expenses. Also, you may use this to calculate the acquisition cost for a particular channel.

Find more examples in the article.

There are, but they’re very conditional and may only confuse you. Comparing your CAC with the Lifetime value acquired users bring to your business is better. The best LTV: CAC ratio is 3:1

Find more CAC examples in the article.

There are many ways to do this, and the correct method will depend on your product. But you can use these:

– Retargeting — it’s much cheaper to nurture those who interacted with your product than to acquire new users,

– Test your creatives for ads before launching — this way, you won’t spoil your marketing budget on an offer that doesn’t work,

– Focus on Buyer personas and ICP — this will help you to create offers that users will find familiar,

– Collect as much data as possible — this will help you understand users’ behavior patterns and correct them through your communications if needed,

– Automate everything you can automate. This point is mostly about marketing automation. This will help you not only to save money on salaries but additionally convert more visitors into leads and sales,

-Increase loyalty. Customers always feel that you care about them. Pay attention to customer service, and don’t be shy to remind yourself — this way, you’ll increase the number of current customers, directly affecting the Customer Acquisition Cost number.

Find more CAC examples in the article.

I wish you higher client onboarding, conversion rates and lower Customer Acquisition Cost. We believe in you!

Read also:

- The best way to collect emails: 5 top-notch methods unveiled

- 3-step guide on inbound lead qualification: how to qualify inbound leads on autopilot

- Choose your ideal lead nurturing platform: Top 10 software tested by experts

- How to implement user tracking on website: guide, tactics, and tools

- Top 10 user activity monitoring tools: tracking features, price, cons and pros

- Acquisition funnel marketing: Grow customer conversions at each step of user journey

- The top 15 inbound marketing tools: harness digital power and elevate your business

- Top 20 best website tracking tools for effective work with visitors

- Top 10 customer segmentation tools to personalize customer communications

![Customer engagement strategy template [expert plan]](https://www.dashly.io/blog/wp-content/uploads/2022/09/Customer-engagement-strategy-template-720x317.png)