Unlocking the Path to Negative Churn

There are two types of churn: churn of customers and of MRR (regular monthly income). The first one is the number of customers who stopped using your software and decided to leave. The MRR churn is money that you lose because customers are leaving. This article will be about money, more specifically about MRR.

As the SaaS service (or eCommerce) grows, its customer base grows, and any churn percentage can significantly affect the company’s profits. To compensate for this loss of revenue, more and more orders are required from new customers. As a result, the growth slows.

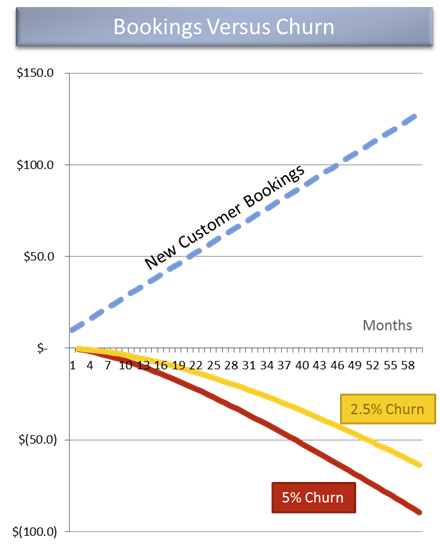

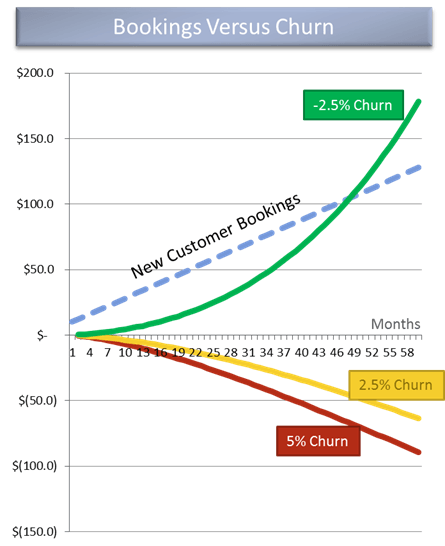

To illustrate this, let’s take a look at the chart below.

Regular monthly income (Monthly Recurring Revenue or MRR) starts from zero, and revenue from new customers starts at $10,000 and then increases by $2,000 each month (shown in blue dotted line).

Yellow and red lines show lost revenue due to the fact that customers cancel the subscription (due to the churn). They show the impact of outflows of 2.5% and 5% monthly, respectively. The charts are counted taking into account your monthly growth.

Looking at the graph above, we will see that the churn is not so significant in the first months of the startup’s life. Instead when the company is approaching the end of the fifth year of its existence, even with a relatively low 2.5% churn, you will lose $64,000 per month, which is very difficult to compensate from new customers. And with a churn of 5% this figure is even more impressive — $90,000.

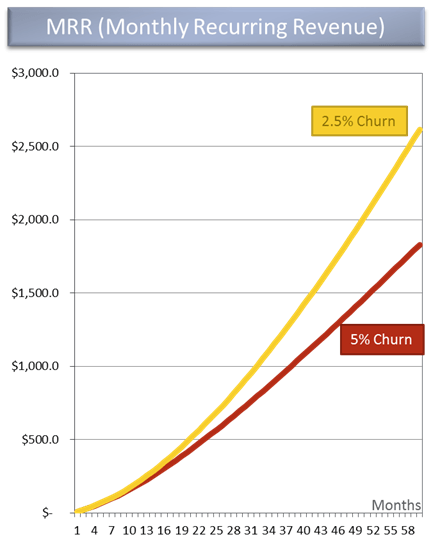

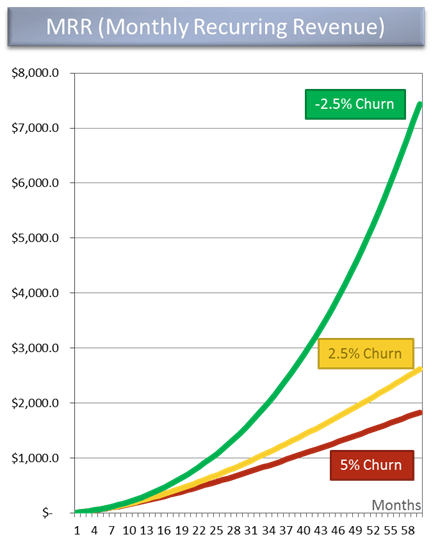

The graph below shows how the MRR grows with a churn of 2.5% and 5%.

Despite the fact that the first months of the difference in income is minuscule, over time it can cause huge losses. Logically, that’s why everyone wants to reduce the churn.

The effect of negative outflow

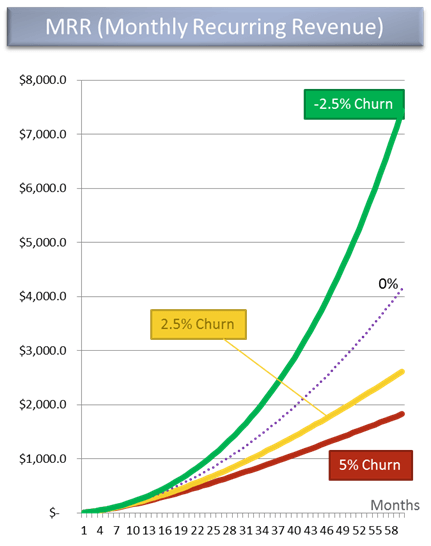

What is Negative Churn? It can be seen in SaaS-services or any other business with constant purchases. This happens when additions / extensions/additional sales/tariff increase for your existing customers exceeds the revenue that you lose because of the churn. The chart below shows what happens if, in addition to your sales to new customers, you receive additional revenue from existing customers at a rate of 2.5% monthly (green line). This is the negative churn.

Negative churn is possible not only in the case of SaaS-services. For example, you sell a product with a specific life cycle. Let’s say bread. Regular customers come to you every day (or every other day). If they buy more expensive bread, then this will be a negative churn.

The result is amazing. Increasing revenue from existing customers and obtaining a negative churn leads to a large increase and by the end of the fifth year reaches $180,000 monthly. Let’s look at the growth of the overall MRR:

This is an amazing result. Business with a negative outflow of -2.5% is almost 3 times more than the same with a standard churn of 2.5% (note that this figure is considered very good). Obviously, negative churn is the most powerful growth accelerator.

And what if you fail to achieve a negative churn, but you can reduce the churn to zero? Here’s how the MRR will look in this case:

Of course, the zero churn (that is, the situation when customers do not leave you at all) is much more effective for your earnings than the loss of 2.5 or 5% of customers every month. But look how far ahead your business is if you manage to achieve a negative churn. The difference is colossal.

Impact of negative churn on income from a customer cohort

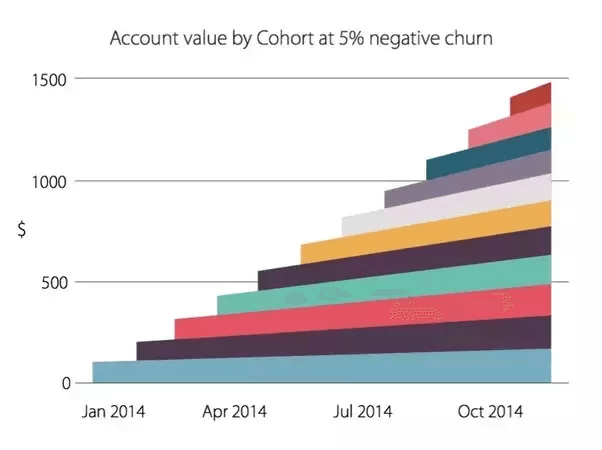

Look at the chart below. It clearly demonstrates the effect of negative churn on cohorts.

Each bar is the amount of revenue from one cohort of customers. Note that at the end of the graph the band expands, that is, each cohort brings more money, a negative churn is observed. On the scale of one cohort, this is not particularly noticeable, but each subsequent cohort brings more and more money and the chart goes uphill more and more. This is the whole force of negative churn.

How to achieve negative churn

The transition to a negative outflow requires at least one of the following three:

- Increase revenue from the existing product. The best way to do this is to implement a pricing policy based on usage metrics that grow over time. For example, Dropbox takes more money from you if you use more space. Email sending services increase the cost as the base of your subscribers grows. And so on.

- Up-sell. Offer customer more options when switching to a more expensive tariff.

- Cross-sell (additional sales). Offer customers additional products and services.

Who should do additional sales?

There are no strict rules, but sometimes it is recommended to divide the sales department into “hunters” who will pursue new customers, and “farmers” who will work to increase revenue from existing customers. There are two reasons for this:

- Focus: if I’m a seller who has a choice — to call an existing customer to increase revenue, or a new one — I’d rather choose an existing one, because it’s easier. As a result, attention to a new customer is reduced.

- A different set of skills: The skills required for additional sales are often aimed at how to help the customer to succeed with the product. This is more part of consulting, support and expertise in the product, rather than the sales skill.

When to focus on the negative churn?

If you are in the early stages of the development of your startup, you should not immediately focus on complex pricing schemes and split the product into parts for additional sales and cross-sales. Most likely, in the first 12-14 months of your business life it is too early to deal with a negative churn. At this stage, it is more important to understand the customers. For this, a simple pricing policy is better.

However, even in the early stages, the startup is recommended to focus on reducing the outflow. A high outflow usually serves as a clear indicator that your service does not meet the needs or expectations of customers. This can not be a guarantee of long-term success.

Tactics that help reduce the churn

Despite the fact that we are talking about the outflow of incomes to reduce it, we will have to work with the customers churn. After all, they bring you money.

Here are some quick recommendations.

- Make your customers happy. More often, customers leave if the product does not meet their expectations or solve the problem. The more you adapt your product to the target audience and the more attention you give to your customers, the fewer people will want to leave you.

- Build a competent onboarding. It’s a shame to lose customers just because they did not understand your product. Evaluate what functions in your software are key and always pay attention to them newcomers.

- Analyze the target audience. Returning to item 1, the better you understand the needs of the target audience, the better your product adapts to its needs.

Managing the churn is more difficult if you sell to small businesses.

The reason is that many small companies are quickly closing. They also cut costs faster when things do not go very well.

In addition, achieving negative churn is difficult, since many small companies have a strictly limited budget, which they can spend on other services. Therefore, if you work in B2B, you should understand that it will be extremely difficult to achieve a negative churn.

How Churn affects Business Valuation

If you represent your service to investors, assume that they will pay close attention to the churn indicators even at the earliest stages of your startup. For them, the churn will be an indication of how well your product fits into the market.

Security buyers also realized the importance of churn in SaaS-services. One of the largest investment banks published a report, which talks about the factors that affect the evaluation of SaaS-services. While the main factor influencing the increase in revenue is the growth rate, it clearly shows that return and additional sales are strong secondary factors. The report says that an increase in retention by 2% leads to an increase in revenue by 20%, and an increase in additional sales by 2% leads to an increase of 28%.

Register today and see how Dashly will affect your churn for free within the first 7 days.

Read also:

⭐ Build an Effective Sales Funnel Email Sequence in 2025 [11 Success Stories]

⭐ Is Your Sales Funnel Leaking? 6 Strategies to Fix It Fast